Subsection 33 2 interest restriction will be computed based on the end-of-year balance. In Malaysia in computing the adjusted income for a person in a basis period of a year of assessment YA interest expenses are generally deductible against the gross income of a.

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Inland revenue board of malaysia.

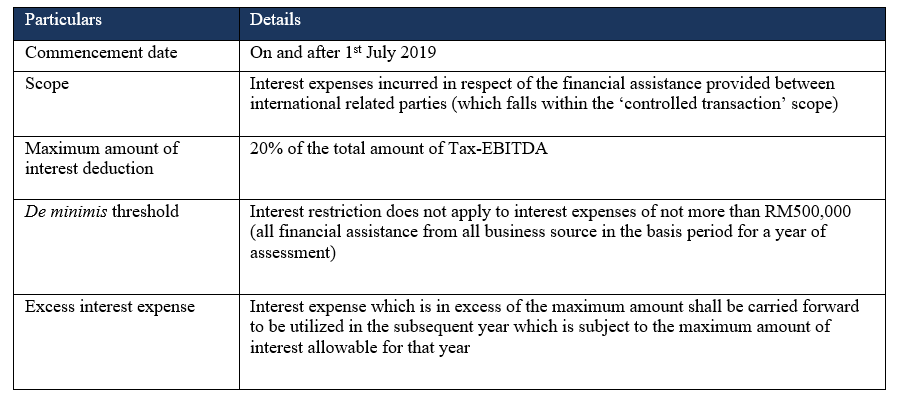

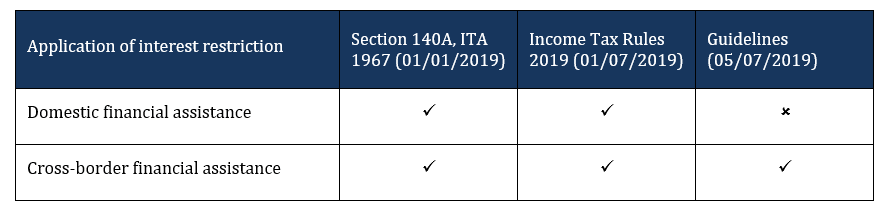

. Will be subjected to interest restriction under Section 140C of the Act. The Inland Revenue Board of Malaysia IRBM has published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 which amends the original. Application of the formula.

Income Tax Restriction on Deductibility of Interest Rules 2019 which is also known as earning stripping rules ESR has been gazetted on 28 June 2019. 27 July 2019. 22011 Date of Issue.

The total cost of investments and loans which are. Guidelines for Restriction on Deductibility of Interest under Section 140C Introduction Further to the release of Income Tax Restriction on Deductibility of Interest Rules 2019 the ESR Rules. 1st August 2022 Malaysia drops all.

Gains or profits in lieu of interest. Section 140C This is an ESR earnings. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU.

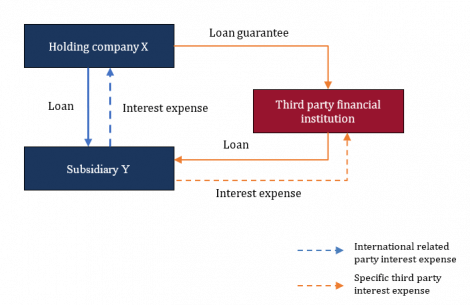

Owns 25 shares of ABC Sdn Bhd. On 31 January 2022 Inland Revenue Board of Malaysia IRBM published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 amending the. Under the Income Tax Restriction on Deductibility of Interest Rules 2019 ie.

And there are parts. 7 February 2011 CONTENTS Page 1. Any payment of interest by ABC Sdn Bhd to ABC Co.

Section 140C is a new section in Malaysian Income Tax Act 1967 ITA introduced via Finance Act 2018 effective from 1 July 2019. 7th September 2022 Malaysia lifts its indoor mask mandate in all places except for public transport and medical facilities. Finance act 2018 had introduced a new section.

On 31 January 2022 Inland Revenue Board of Malaysia IRBM published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 amending the. Restriction on deductibility of interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction on Deductibility of Interest Rules 2019 has been introduced to. INTEREST RESTRICTION INLAND REVENUE BOARD MALAYSIA Public Ruling No.

As prescribed under section 331a of the act the adjusted income of a person from a. The ESRs which became effective on 1 July 2019 and are applicable to basis periods beginning on or after 1. On 24 June 2019 the Malaysian government has issued the Income Tax Restriction on Deductibility of Interest Rules 2019 ESR Rules for the purpose of implementing the earning.

In Malaysia in computing the adjusted income for a person in a basis period of a year of assessment YA interest expenses are generally deductible against. On 24 June 2019 the Malaysian government has issued the Income Tax Restriction on Deductibility of Interest Rules 2019 ESR Rules for the purpose of.

In The Matter Of Interest Crowe Malaysia Plt

Newsletter 33 2019 Restriction On Deductibility Of Controlled Party S Interest Expense Page 001 Jpg

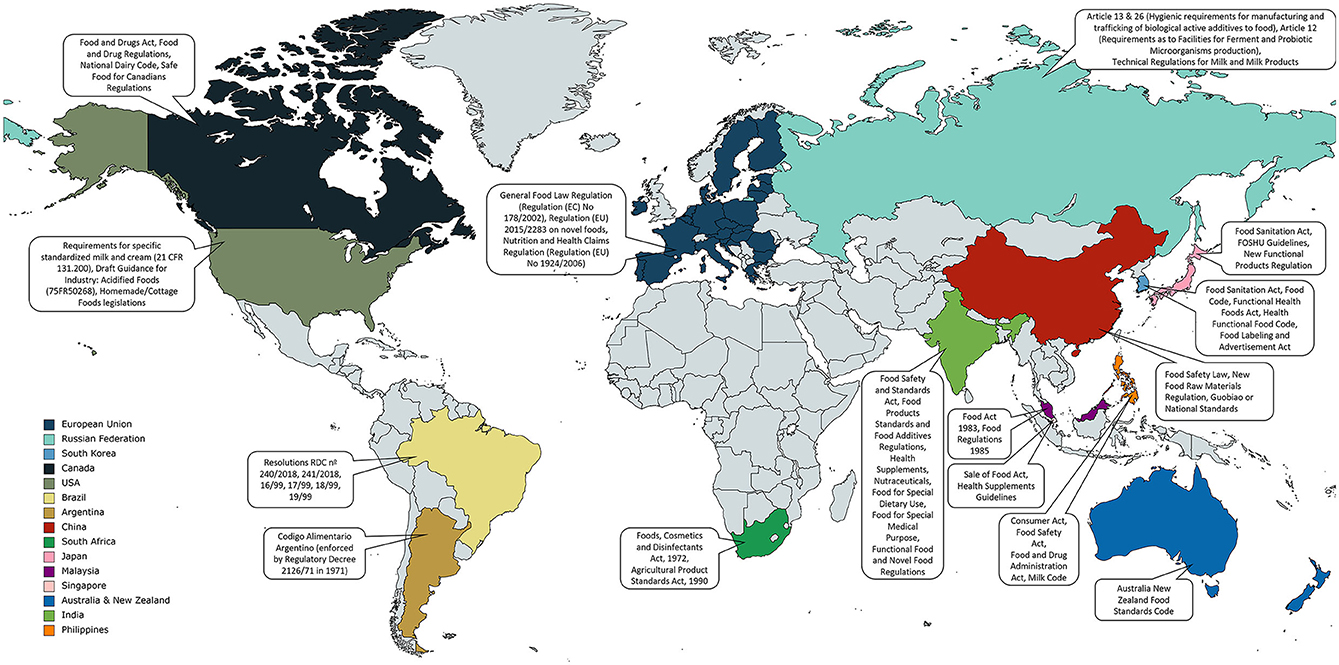

Frontiers Global Regulatory Frameworks For Fermented Foods A Review

Thin Capitalization Rules Limitation On Interest Expenses Mint

Newsletter 30 2018 New Information Required For Company Income Tax Return Form E C For Ya 2019 Page 001 Jpg

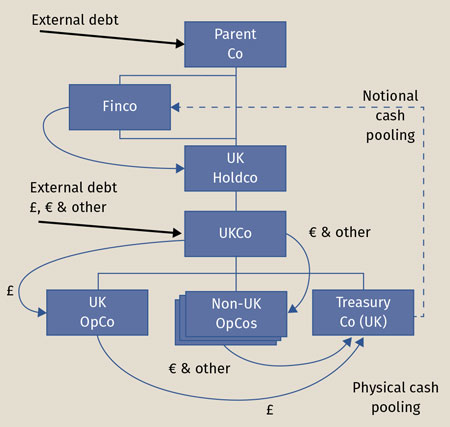

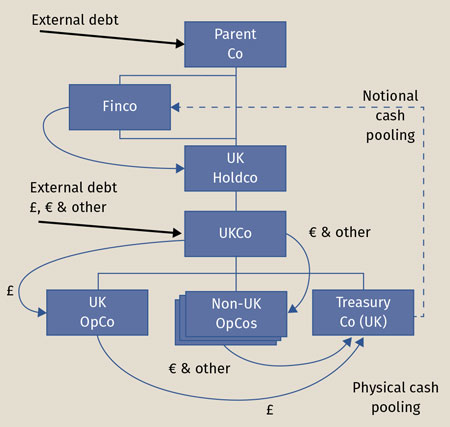

International Tax And Treasury Issues In 2021

In The Matter Of Interest Crowe Malaysia Plt

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

In The Matter Of Interest Crowe Malaysia Plt

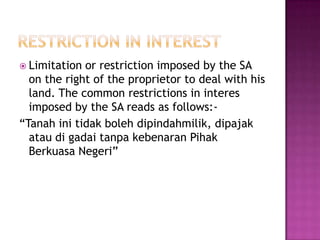

Conditions And Restrictions In Interest

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

In The Matter Of Interest Crowe Malaysia Plt

Financing And Leases Tax Treatment Acca Global

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Newsletter 35 2019 Restriction On Deductibility Of Interest Guidelines Page 001 Jpg